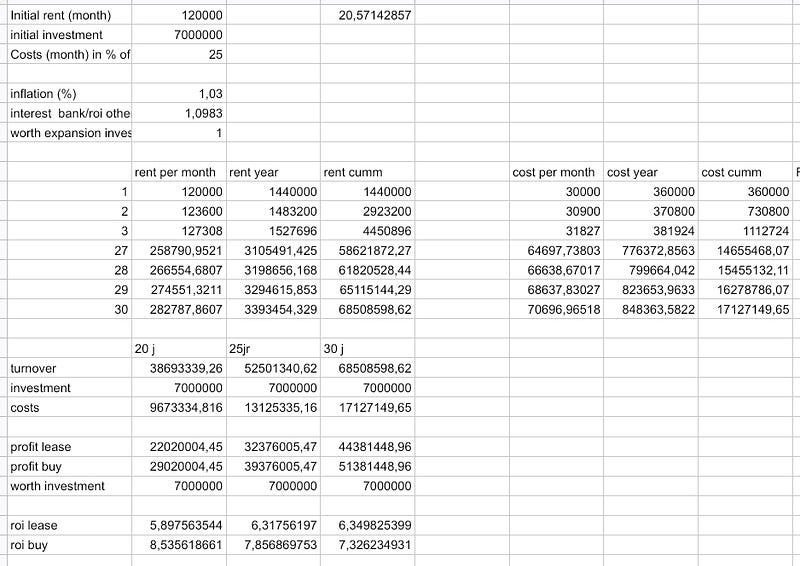

In this analysis, we’re juxtaposing the Return on Investment (ROI) presented by brokers against the actual ROI.

Brokers gauge the annual rent percentage (after deducting expenses) relative to the initial investment, giving ROI’s up to 20%.

This evaluation spans the entire investment period, factoring in yearly rent increments.

We’re exploring scenarios for both freehold and leasehold properties. For freehold cases, the property’s appreciation is factored in, while leasehold scenarios consider the investment’s worth as zero at the conclusion.

Methods

These calculations are conducted in a Google Sheet using straightforward formulas.

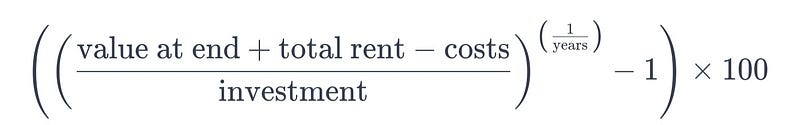

The ROI is determined by the formula:

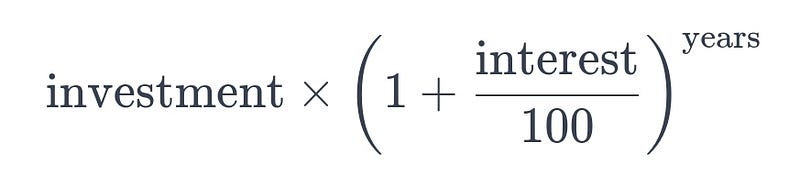

Meanwhile, the formula used for calculating the final yield of the saving account is:

Results

The calculations can be viewed in the Google Sheet

Conclusion

Despite rents amounting to 20% of the investment price, the ROI over a 20 to 30-year period remains at only 6 to 8.5%.

Discussion

- There is potential increase or the decrease in the object’s value.

- The rental rates might fluctuate, either rising or falling, influenced by factors such as pandemics, climate change, shifts in international laws, and taxation variations